Disclosure

This content is provided for general informational purposes only, and is not intended to constitute investment advice or any other kind of professional advice. Before taking action based on such information, we encourage you to consult with appropriate professionals. We do not endorse any third parties referenced within the aforementioned article. Do not infer or assume that any securities, sectors or markets described in this article were or will be profitable. In addition, past performance is no guarantee of future results. There is a possibility of loss. Historical or hypothetical performance results are presented for illustrative purposes only.

15 best tips for high earners to reduce taxable income (2024)

Learn how to reduce taxable income for high earners with these 15 simple tips. Plus, discover what baseline tax rules affect people with six-figure incomes.

What's Playbook? We're your friendly step-by-step app for growing your money and minimizing taxes so you can live the life you want, sooner. Learn more

Key takeaways

- If you’re a high-income earner, tax season is probably a bittersweet experience. On the one hand, it reminds you of your success, but on the other, you may dread the hefty tax bill.

- You know you’re reasonably secure, but are you sure you’re doing all you can to squash that tax liability?

- To ease your mind, we’ll explain how to reduce taxable income for high earners while staying in the IRS’s good graces.

- We’ll also look at what it means to be a high-income earner, explore the tax thresholds, dive into essential tax rules, and reveal the 15 best strategies to keep more hard-earned money in your pocket.

What is a high-income earner according to the IRS?

According to the IRS, a high-income earner is anyone who makes more than $182,101 or a couple who makes more than $364,201. These high earners make significantly more than the average American, who earns just above $57,000 as of the second quarter of 2023, according to the Bureau of Labor Statistics.

The definition of a high earner can vary year to year due to inflation, but you’ll typically fall into this category if you earn well above six figures annually. Earnings can come in many forms – wages and salaries, retirement distributions, business income, investment income, and more.

What’s the tax threshold for high-income earners?

For the 2023 tax year, a high-income earner makes more than $182,101 or $364,201 for couples filing jointly.

Individuals with a taxable income of more than $578,125 and married couples filing jointly with a taxable income above $693,750 are subject to the highest federal tax rate of 37%.

There are seven tax brackets for the 2023 tax year (the taxes you file in 2024):

What tax rules do I need to know about?

Before we dive into our high-income tax strategies, let’s briefly touch on some essential tax rules and basics that you should be aware of as a top earner:

- Marginal tax rates: Remember, the U.S. tax system is progressive, not flat. That means you don’t pay the highest tax rate on your entire income, only the portion that falls within that tax bracket. If you’re single and earn $183,000 per year, only $900 will be taxed at 32%. Every dollar you earn from $95,376 to the $182,100 threshold will be taxed at 24%, every dollar from $44,726 to $95,375 taxed at 22%, and so on.

- Alternative minimum tax (AMT): The AMT is a parallel tax system designed to ensure that high-income individuals and corporations pay a minimum amount of tax, regardless of deductions and credits. Being mindful of the AMT can help you avoid unpleasant tax surprises.

- Investment taxes: High earners often have significant investments that generate income. Minimizing taxes on capital gains, dividends, and interest is crucial if you want to optimize your tax strategy.

- Automatic opt-in: Employer plans can automatically take contributions from employee paychecks (pre-tax) unless the employee specifically opts out or changes the amount of their contribution.

Investors should also know about the SECURE Act of 2019. The Setting Every Community Up for Retirement Enhancement (SECURE) Act introduced several important changes to retirement planning that affect high-income earners, like:

- Extending the age for required minimum distributions from 70½ to 72.

- Eliminating the “stretch IRA” to require non-spouse beneficiaries to withdraw inherited IRA balances within 10 years, possibly increasing tax liability for those with big balances.

- Expanding retirement plan access to part-time employees.

- Allowing qualified birth or adoption distributions of up to $5,000 from retirement accounts.

You get the picture – reducing taxable income requires a multifaceted offensive that plays all sides. Luckily, you don’t have to go it alone. You can talk to an adviser to help ease you through these rules and basics, or better yet, use a tax minimization strategy like the one Playbook employs to nip your tax bill in the bud without lifting a finger.

15 best strategies to reduce taxable income

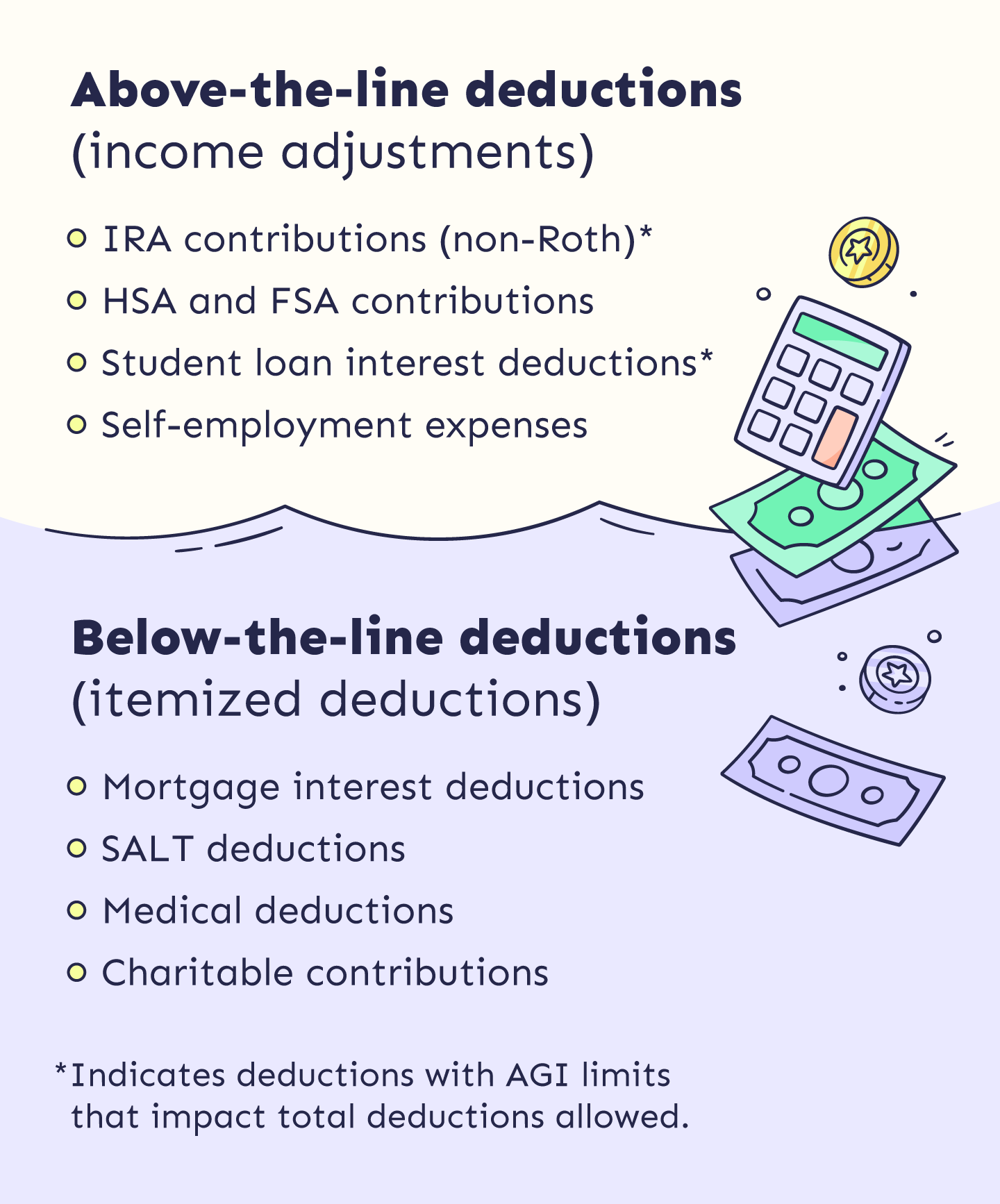

Tax reduction strategies generally take advantage of deductions. Below, we’ll explore two different categories of deductions: above-the-line and below-the-line.

Now for the goods you’ve been waiting for. Here are the 15 smartest tax strategies for high-income earners to shrink their taxable income – call it “How to Pay Less Taxes 101.”

1. Convert to a Roth IRA.

The Roth IRA is like a hidden treasure chest for high earners looking to reduce their taxable income in the future. While the IRS imposes income limits on direct contributions to Roth IRAs, there are workarounds known as the backdoor Roth IRA, or a mega backdoor Roth IRA.

You start by making non-deductible contributions to a traditional IRA. Since these contributions aren’t tax-deductible, they don’t immediately reduce your taxable income. However, the magic happens when you convert the traditional IRA to a Roth IRA. The amount you convert becomes tax-free in retirement.

What makes a Roth IRA so appealing to high earners? It’s all about tax diversification. You can strategically manage your tax liability by having a mix of taxable and tax-free income sources in retirement. Roth IRAs give you flexibility in choosing when and how you take withdrawals, allowing you to minimize the impact of taxes.

- Also worth noting: Roth conversions are even better in a year when your income is lower than the previous year. If you fall in a lower tax bracket, your contributions to the initial IRA will be taxed at a lower rate, further minimizing the tax implications on your retirement plan.

Additionally, Roth IRAs have no required minimum distributions during your lifetime, so you can let your investments grow tax-free for as long as you wish. This can be an incredible advantage for passing wealth down to future generations. However, an inherited Roth IRA generally must be withdrawn within 10 years.

However, you need to watch out for the Pro-Rata rule if your traditional IRA has pre- and post-tax contributions. It gives you a formula to calculate the non-taxable percentage of your total IRA balance and how much of your after-tax funds are taxable once you convert them.

- First, divide the non-deductible amount by your total non-Roth IRA balance to get the percentage that’s non-taxable. This is your non-taxable percentage.

- Then, multiply the amount you want to convert by that non-taxable percentage to get the dollar amount that’s taxable once converted.

2. Maximize your retirement contributions.

One of the most powerful tools for reducing taxable income is maxing out your retirement contributions. High earners may be able to afford to contribute significantly more to retirement accounts than the average American.

Here are some key accounts to consider:

- 401(k) and Roth 401(k): For 2023, the annual contribution limit to a 401(k) is $22,500, with an additional catch-up contribution limit of $7,500 if you’re age 50 or older. Contributing the maximum amount to a traditional 401(k) is worth it to reduce your taxable income by that much in a year, while Roth 401(k)s offer tax-free withdrawals at retirement. And if your employer offers a matching contribution, that’s free money toward retirement.

- Traditional and Roth IRAs: You can still contribute to traditional and Roth IRAs, but the tax benefits can vary. Traditional IRA contributions may not be tax deductible if you’re covered by an employer-sponsored retirement plan and your income exceeds certain limits. However, Roth IRAs offer an opportunity for tax-free withdrawals in retirement, as we covered earlier.

- SEP-IRA and Solo 401(k): If you’re self-employed or have freelance income, consider setting up a Simplified Employee Pension (SEP-IRA) or a Solo 401(k). These plans allow for substantial contributions based on your self-employed income, which can be a fantastic way to reduce your taxable income while saving for retirement.

You should note that you’ll only be able to reduce your tax burden with IRA and 401(k) contributions in a given year if you can contribute solely to a traditional plan and not a Roth account.

3. Use health savings accounts (HSAs) and flexible spending accounts (FSAs).

Healthcare expenses can be a significant portion of your annual spending, but they also present an opportunity to save on taxes. You may be able to use an HSA or FSA to achieve these savings.

- HSAs are available to individuals with high-deductible health insurance plans. Contributions to HSAs are tax-deductible, and you can use the money tax-free for qualified medical expenses. The annual contribution limits for HSAs can be quite generous, too. You can also invest your balance for tax-free growth at a certain limit.

- FSAs are typically offered by employers and allow you to set aside pre-tax dollars for eligible medical expenses. Unlike HSAs, FSAs may have an annual “use it or lose it” provision, so plan your contributions carefully.

4. Up your charitable contributions.

Being a high earner comes with the capacity to make a significant impact through charitable giving. Charitable contributions not only benefit worthy causes but also offer tax deductions for high earners. To optimize your charitable giving, you might want to consider:

- Donor-advised funds, which allow you to make a lump-sum contribution to the fund and then hand out grants to select charities when you choose. The initial contribution is tax-deductible, allowing you to maximize your charitable deductions in a high-income year.

- Appreciated assets like stocks or real estate instead of a cash gift. By doing so, you can avoid capital gains taxes on the asset’s appreciation and claim a charitable deduction for its fair market value. Talk about double-dipping!

- Bunching donations if your charitable giving tends to vary from year to year. This involves consolidating multiple years’ worth of charitable contributions into one year to exceed the standard deduction threshold.

Three other prime charitable giving strategies that can scratch your philanthropic itch are:

- Charitable Remainder Trusts (CRTs): These allow you to donate appreciated assets to a trust, which then pays you or a designated beneficiary an income stream for a specified period. After that, the remaining assets go to your chosen charity. You receive an immediate charitable deduction and often avoid the capital gains tax on the donated assets.

- Charitable Lead Trusts (CLTs): These allow you to transfer assets to a trust that makes annual payments to a charitable organization for a specific period. After that period, the remaining assets go to your beneficiaries. CLTs help reduce estate taxes while benefiting your heirs and favorite charitable causes.

- Qualified Charitable Distributions (QCDs): These allow people 70.5 years old and older to directly donate up to $100,000 from a taxable IRA account instead of receiving minimum distributions. This helps you avoid a higher tax bracket that can impact other deductions.

5. Make more tax-efficient investments.

Investing is a cornerstone of building wealth, and tax-efficient investing for high earners is a great way to beat the tax implications of ordinary investments.

There are a couple of investing strategies that can help you with your tax minimization goals:

- Tax-efficient funds like index funds or exchange-traded funds (ETFs) are tax-light or even tax-free investments and more tax-advantaged than actively managed funds.

- Holding investments for more than one year can qualify you for lower (or even zero) long-term capital gains tax rates.

- Asset location involves placing tax-inefficient investments in tax-advantaged accounts and tax-efficient investments in taxable accounts. This flip-flop can optimize your tax liability by minimizing any taxes owed on those investments.

6. Harvest your tax losses.

Nobody likes to see their investments in the red, but it can happen occasionally. However, there’s a silver lining: tax-loss harvesting. This strategy allows you to offset capital gains and reduce tax liability.

If you have investments that decrease in value (capital losses), you can sell them to offset capital gains. If your capital losses exceed your capital gains, you can even use the excess losses to offset other income up to a certain limit.

Just be aware of wash-sale rules, which prevent you from buying back the same or substantially identical securities within 30 days of selling them.

7. Use business ownership for further deductions.

High earners with a side hustle, self-employment income, or ownership stake in a business can also reduce taxable income through business-related deductions, like:

- Home office deductions if you use a portion of your home exclusively for business purposes, whether you rent or own. However, this requires adherence to strict IRS criteria.

- Business expenses associated with travel, meals, entertainment, supplies, and more. But keep detailed records – you’ll need these to back up any expense deductions you make.

- Retirement plans if you’re self-employed. You’ll have access to options like a Solo 401(k) or SEP-IRA to make significant deductions to reduce your taxable income.

- Restructuring your entity under certain circumstances. Since businesses evolve, you may find that your business better fits a different structure than the one you originally started it under. Some business structures have fewer tax consequences than others for owners, like LLCs and S corporations.

8. Invest in real estate.

Real estate investment can be a tax-friendly avenue for high earners, whether you already own property or not. These top strategies can play a role in your portfolio:

- Mortgage interest deduction: If you own a primary residence and have a mortgage, you can deduct the interest you pay on that mortgage up to certain limits. This deduction can benefit high earners with substantial mortgage interest payments.

- Depreciation deduction: The IRS allows you to deduct a portion of your property’s cost each year as depreciation, even if the property value appreciates. The caveat is that the property has to be used for a business or another income-producing activity – you can’t just write off depreciation on your primary residence.

- 1031 exchange: This tax deferral strategy allows you to sell one investment property and reinvest the proceeds in another like-kind property without immediately recognizing capital gains.

9. Defer your income to lower tax liability.

Timing is everything when it comes to taxes, and income deferral is an easy way to give the tax person the slip while passing the buck down the line, slowly phasing out your current tax liability. Some of the best tax deferral strategies are:

- Deferred compensation plans, which allow you to defer a portion of your salary, typically into a tax-advantaged account. The deferred income is not taxed until you receive it in the future, such as in a year when your income is down, and your tax bracket might be lower.

- Stock options and grants, which you can choose when to exercise and realize the associated income from. By carefully timing when you exercise these options, you can control when you recognize the income, allowing you to defer it to a more tax-efficient year when you’re making less.

- Bonuses and year-end income as a holdout plan. If you anticipate a high-income year, consider deferring any bonuses or additional income to the following year if possible. This can help smooth out your taxable income over multiple years and potentially reduce the overall tax rate applied to your earnings.

10. Take advantage of SALT deductions.

SALT, or state and local taxes, can take a huge chunk of your income, depending on where you live. Fortunately, taking advantage of SALT deductions can help reduce federal taxes. Do two things to take advantage of these deductions:

- Itemize your deductions. To claim SALT deductions, you’ll need to itemize your deductions on your federal tax return instead of taking the standard deduction. This allows you to deduct up to $10,000 in state income taxes, property taxes, and even certain local taxes from your federal taxable income.

- Be mindful of state tax planning. Some states offer tax credits, deductions, or incentives for specific activities, such as investing in certain industries or supporting renewable energy initiatives.

Your state might also offer a tax deduction or credit for contributions to a 529 plan. Your home state might require you to contribute to its own 529 plan to receive those tax benefits, but some states allow state tax benefits for contributions to any 529 plan.

11. Explore tax-efficient giving.

Say you have a family member who needs a little help with their expenses – did you know you can give them a hand while also reducing your tax liability? Here’s how:

- Max out the annual gift exclusion. In 2023, the IRS allows you to give up to $17,000 to as many people as you want without incurring gift taxes or reducing your lifetime gift and estate tax exemption.

- Pay for education and medical expenses. Payments made directly to educational institutions for someone else’s tuition or medical providers are not considered gifts for tax purposes. The sky’s the limit here as long as the expenses are legitimate.

12. Invest in Qualified Small Business Stock (QSBS).

Under certain conditions, the tax code allows for a partial or complete exclusion of gains from the sale of QSBS. The rules surrounding QSBS are complex and have specific requirements, though, so don’t just take this up on your lunch break. Consult with a tax professional before heading down this road.

13. Plan tax-efficient withdrawals in retirement.

Reducing taxable income doesn’t stop at the accumulation phase; it extends into retirement when you start withdrawing money from your savings.

- Tax diversification: As we touched on earlier, it pays to diversify your retirement savings across different account types, such as traditional IRAs, Roth IRAs, and taxable brokerage accounts. This gives you flexibility in choosing which accounts to draw from in retirement, potentially minimizing your tax liability each year.

- Roth IRA ladder: This is a prime strategy if you plan to retire early. You’ll convert traditional IRA funds into Roth IRAs gradually, which can result in tax-free withdrawals after a five-year waiting period. These ladders are best if you plan for your future self to be in a higher tax bracket than you are now since traditional IRAs require you to pay taxes upon withdrawal.

- Delay Social Security: This can increase your monthly benefit amount and potentially reduce the need for tapping into other taxable income sources early in retirement, allowing them to continue to grow and grow.

Speaking of tapping into income sources in retirement, the order in which you withdraw funds from various accounts can significantly impact your overall tax liability.

A tax-efficient withdrawal sequence typically involves four stages:

- Tapping into taxable accounts that may have lower tax implications, like investments with long-term capital gains

- Withdrawing from tax-deferred accounts like traditional IRAs or 401(k)s

- Accessing tax-free accounts like Roth IRAs

- Moving on to collect delayed Social Security benefits

This sequencing can max out the life of your retirement savings, which is especially helpful if you can retire early.

14. Create a tax-efficient legacy plan.

High earners often have larger estates that can face hefty estate tax penalties. To minimize the impact of these tricky tax burdens and leave a tax-efficient legacy, try taking advantage of:

- Estate tax exemptions. As of 2023, the federal estate tax exemption is $12,920,000 per person. Any inheritance within those bounds won’t owe federal estate taxes.

- Gifting strategies. We mentioned tax-efficient gifting above, but you can employ gifting strategies to gradually reduce the size of your taxable estate, too. This includes strategies like grantor-retained annuity trusts (GRATs) to make large, tax-free gifts to heirs, as well as family limited partnerships (FLPs) that give family members shares of a family business without burdens from estate taxes.

- Irrevocable life insurance trusts (ILIT): You can establish an ILIT to hold life insurance policies outside your taxable estate. This can provide your heirs with liquidity to cover any estate taxes without increasing the taxable value of your estate.

15. Seek out intelligent, professional advice

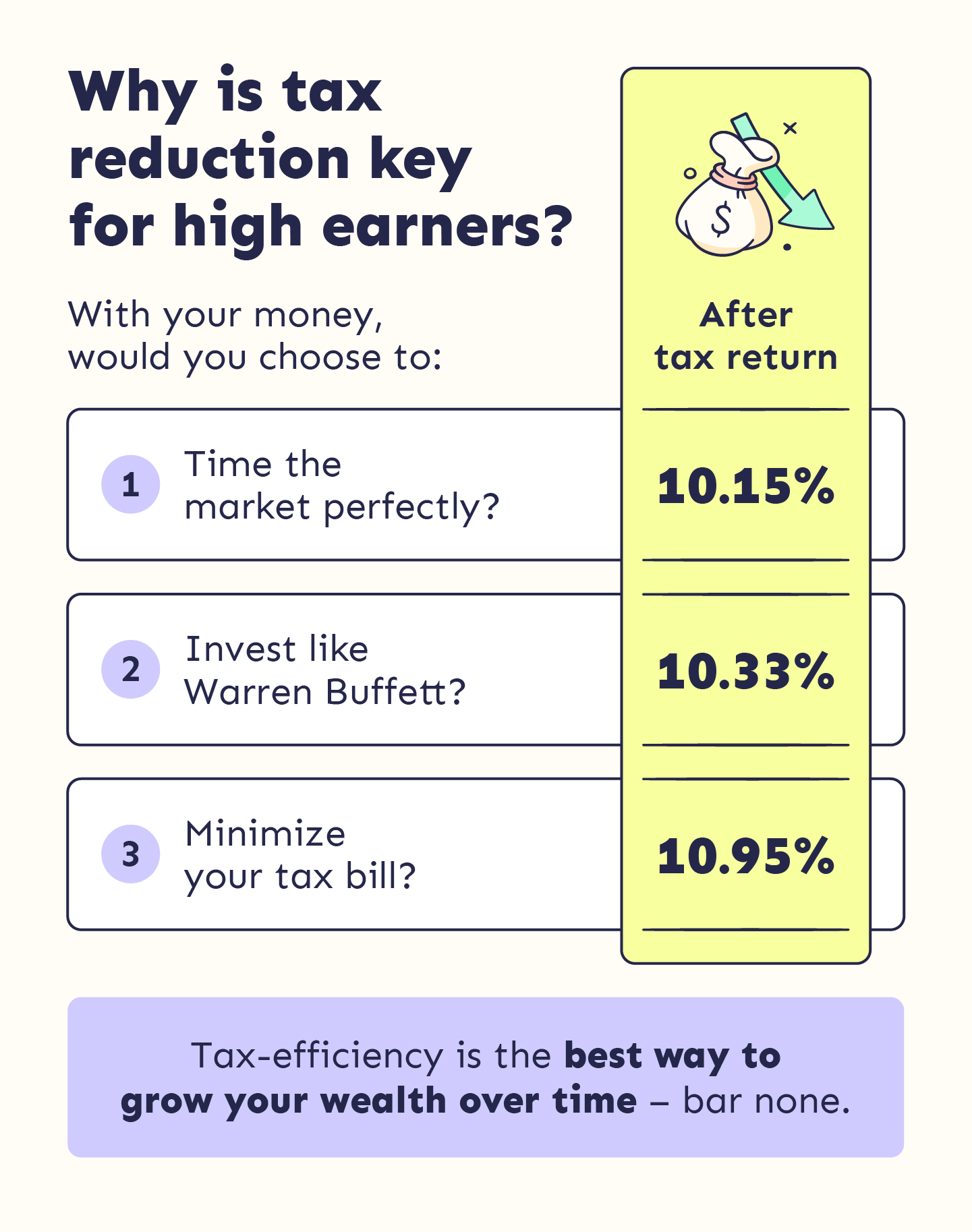

Tax reduction is a year-round sport. You not only need to stay on top of your own evolving financial situation, but you’ve got to keep an eye on constantly changing tax laws for true long-term tax efficiency.

There are many people in your corner to help you stay one step ahead of Uncle Sam, like CPAs, enrolled agents, financial advisers, and tax attorneys. Or, you can level up with smart, independent wealth building through a tax-minded tool like Playbook that takes this weight off your shoulders and adopts an adaptive tax reduction strategy that grows with you.

Don’t let taxes get the best of you.

Taxes are a part of life. But they should get a footnote, not a whole chapter in your book. Instead, commit to figuring out how to reduce your taxable income if you’re a high earner.

Tax-minimization strategies are aplenty, and with a little help from an adaptive financial planning tool like Playbook, you can lean into long-term wealth building and avoid long-term regret from not taking advantage of these easy tips.

.png)